Advertisement

-

Published Date

July 6, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

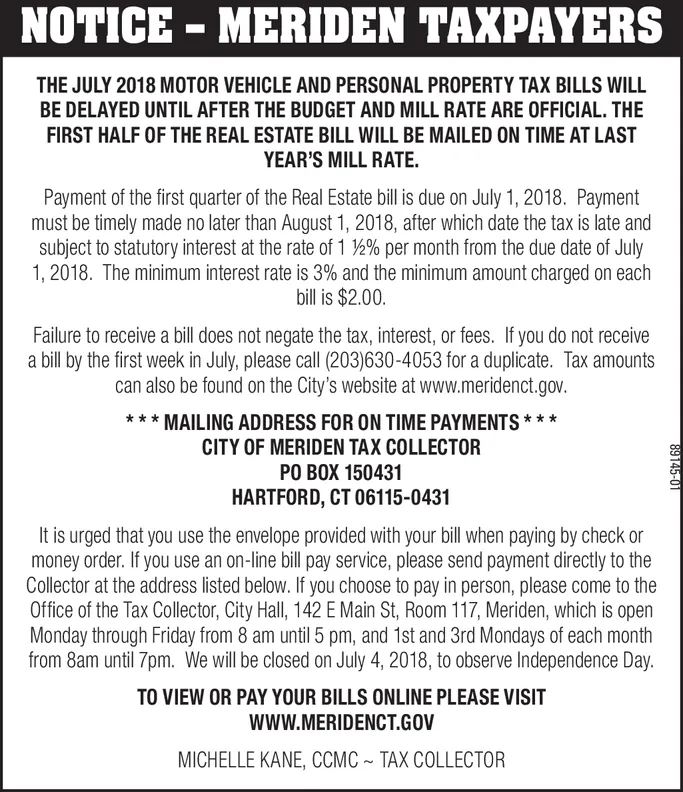

NOTICE-MERIDEN TAXPAYERS THE JULY 2018 MOTOR VEHICLE AND PERSONAL PROPERTY TAX BILLS WILL BE DELAYED UNTIL AFTER THE BUDGET AND MILL RATE ARE OFFICIAL. THE FIRST HALF OF THE REAL ESTATE BILL WILL BE MAILED ON TIME AT LAST YEAR'S MILL RATE. Payment of the first quarter of the Real Estate bill is due on July 1, 2018. Payment must be timely made no later than August 1, 2018, after which date the tax is late and subject to statutory interest at the rate of 1 % per month from the due date of July 1, 2018. The minimum interest rate is 3% and the minimum amount charged on each bill is $2.00 Failure to receive a bill does not negate the tax, interest, or fees. If you do not receive a bill by the first week in July, please call (203)630-4053 for a duplicate. Tax amounts can also be found on the City's website at www.meridenct.gov ***MAILING ADDRESS FOR ON TIME PAYMENTS** CITY OF MERIDEN TAX COLLECTOR PO BOX 150431 HARTFORD, CT 06115-0431 It is urged that you use the envelope provided with your bill when paying by check or money order. If you use an on-line bill pay service, please send payment directly to the Collector at the address listed below. If you choose to pay in person, please come to the Office of the Tax Collector, City Hall, 142 E Main St, Room 117, Meriden, which is open Monday through Friday from 8 am until 5 pm, and 1st and 3rd Mondays of each month from 8am until 7pm. We will be closed on July 4, 2018, to observe Independence Day. TO VIEW OR PAY YOUR BILLS ONLINE PLEASE VISIT WWW.MERIDENCT.GOV MICHELLE KANE, CCMC TAX COLLECTOR